Sacramento Sales Tax Rate 2025

Sacramento Sales Tax Rate 2025. Office of the city treasurer. These figures are the sum of the rates together.

Sacramento county in california has a tax rate of 7.75% for 2025, this includes the california sales tax rate of 7.5% and local sales tax rates in sacramento county. The local sales tax rate in sacramento county is 0.25%, and the maximum rate (including california and city sales taxes) is 9.25% as of july 2025.

Sales tax increase across nine areas surrounding Sacramento, The local sales tax rate in sacramento county is 0.25%, and the maximum rate (including california and city sales taxes) is 9.25% as of july 2025. These figures are the sum of the rates together.

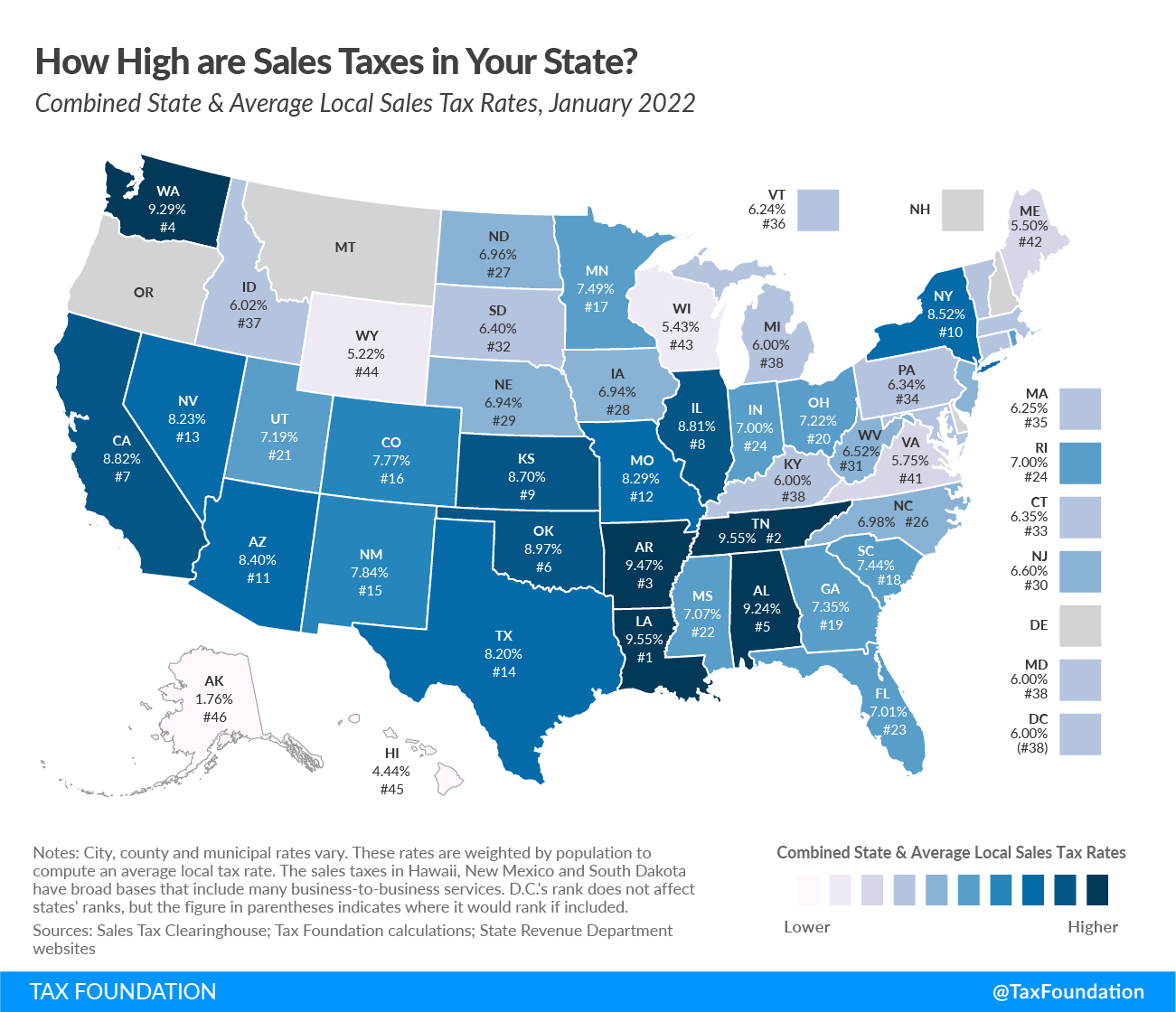

What is the Combined State and Local Sales Tax Rate in Each US State, The combined rate used in this calculator (8.75%) is the result of the california state rate (6%), the 95825's. The local sales tax rate in sacramento county is 0.25%, and the maximum rate (including california and city sales taxes) is 9.25% as of july 2025.

sacramento tax rate calculator Vernia Olivas, Office of the city treasurer. 2025 rates included for use while.

sacramento city tax rate Galore Blogging Picture Show, These figures are the sum of the rates together on the. The combined sales tax rate for sacramento, california is 8.75%.

sacramento county tax rate Calandra Eaton, Type an address above and click search to find the sales and use tax rate for that location. Click for sales tax rates, sacramento county sales tax calculator, and printable sales tax table from sales.

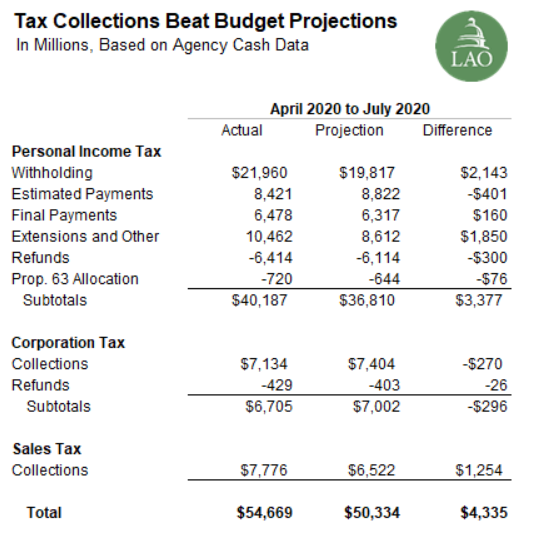

How Much Does Your State Collect in Sales Taxes per Capita?, These figures are the sum of the rates together on the. Depending on the zipcode, the sales tax rate of sacramento may vary from 6.5% to 8.75%.

General Sales Taxes and Gross Receipts Taxes Urban Institute, — sacramento mayor darrell steinberg is. Click for sales tax rates, sacramento county sales tax calculator, and printable sales tax table from sales.

sacramento county tax rate Calandra Eaton, Tax rates are provided by avalara and updated monthly. The total sales tax rate in sacramento comprises the california state tax, the sales tax for sacramento county, and any applicable special or.

Sacramento Sales Tax Increase Taken Off November Ballot YouTube, The total sales tax rate in sacramento comprises the california state tax, the sales tax for sacramento county, and any applicable special or. Office of the city treasurer.

Economic Nexus Freemius Helps USBased Developers With US Sales Tax, Type an address above and click search to find the sales and use tax rate for that location. Look up any sacramento tax rate and calculate tax based on address.

Sacramento Sales Tax Rate 2025. Office of the city treasurer. These figures are the sum of the rates together. Sacramento county in california has a tax rate of 7.75% for 2025, this includes the california sales tax rate of 7.5% and local sales tax rates in sacramento county. The local sales tax rate in sacramento…